Increasing focus is placed on technical solutions to anti-money laundering checks. The potential for new technologies in machine learning, and new tech-focused business models such as utilities, provide enhanced screening for the financial sector to meet legal obligations. At the same time, public sector creation of centralized identity schemes can be politically controversial, while success stories in decentralized identity are relatively few and far between.

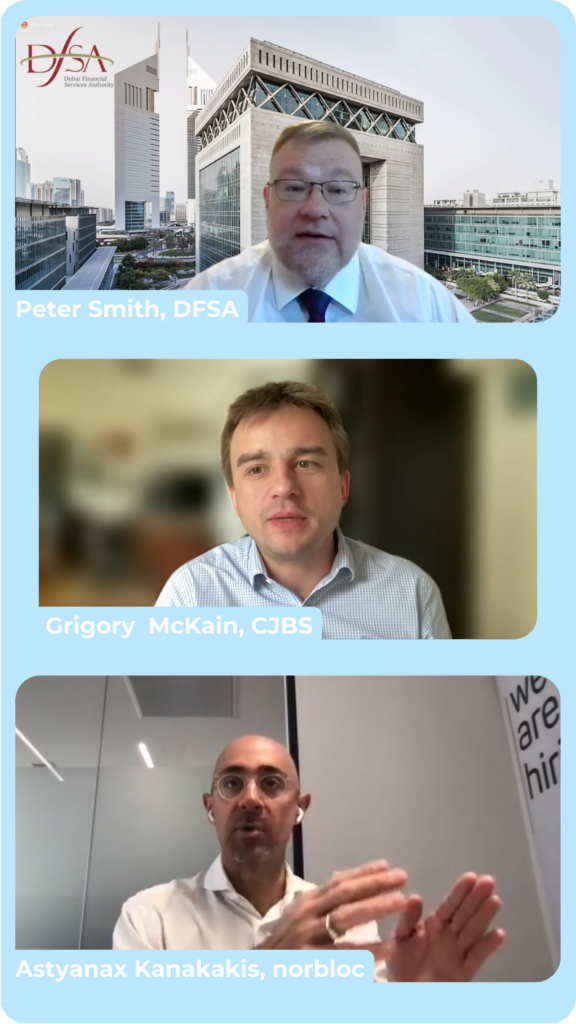

Managing Director of Policy and Strategy at the Dubai Financial Services Authority, Peter Smith and norbloc’s Co-Founder and CEO, Astyanax Kanakakis came together at the Cambridge Regulator Knowledge Exchange forum to discuss current and future practice in the provision of digital identity schemes, distributed identity systems, and the role of the private and the public sector in the creation of new systems.

The market is moving at an extremely slow pace, very unfortunately. However, the market is certainly moving towards utilities whether centralized or decentralized to minimize the cost of compliance to the extent that regulators and regulation allows for cooperation.

As a country, you need to be forward thinking to take the lead in digitization and there needs to be a decision-making authority that can drive this. Consensus-driven decision making in Europe makes everything move slowly, but within the EU there are companies that are forward-looking and are making steps to incorporate innovative solutions to long-lasting hurdles.

Nevertheless, when looking at the latest European eIDAS Regulation, it is worth mentioning that the level of ambition is extremely high covering various industries and fields from education, to health and finance. As highlighted by norbloc’s Co-Founder and CEO, Astyanax Kanakakis, “the difficulty is translating that ambition from regulatory framework into something practical and this will take some time.”

In order for this to be realized there needs to be orchestration of all the key stakeholders and this will be the biggest challenge, so perhaps it is best to begin from one use case and then build up; best to first create ecosystems within jurisdictions before moving to utilities across jurisdictions; best to tackle one vertical before tacking on all verticals.

The difficulty is translating that ambition from regulatory framework into something practical and this will take some time.

For example, norbloc started with KYC but this can expand to include other data such as credit score. When you have created an amazing credit score in one country and are then required to move to another country it feels that citizens are set to start all over again. There are definitely technological solutions for this issue.

There may be blockers within regulation to share credit score data across jurisdictions, but banks sometimes see blockers where there are none. Hence why it is vital to begin discussions between technology providers that include the regulators to find out where there is common ground and space for innovation.

As stated by Managing Director at DFSA, Peter Smith, “There is always flexibility in the regulation, for example, the Regulators say you have to have proof of address and the banks translate this to their clients as you need to provide a utility bill.”

From the regulators perspective it is clear that digitization can be encouraged, but cannot be made solely by the regulators as they do not always have many levers to pull. Regulators will need to become more technologically savvy because the tools used will become more complex and regulators will need to be able to scrutinize these tools even on a code-level. However, the role of the regulator is that of encouragement for companies to innovate and do things differently.

You essentially need someone to pick up the ball and run with it.

For example, there are individual companies digitally onboarding customers, but not so many yet mutualizing this effort as norbloc facilitates despite the fact that the technology exists and that this would be of great benefit. Norbloc connects different institutions allowing them to cooperate and mutualize the effort of compliance; If individuals cannot see the mutual self-interest in taking KYC digitization forward, you essentially need someone to pick up the ball and run with it in order to transform the status quo.

For more information about this discussion contact: alkisti@norbloc.com