Payment Services

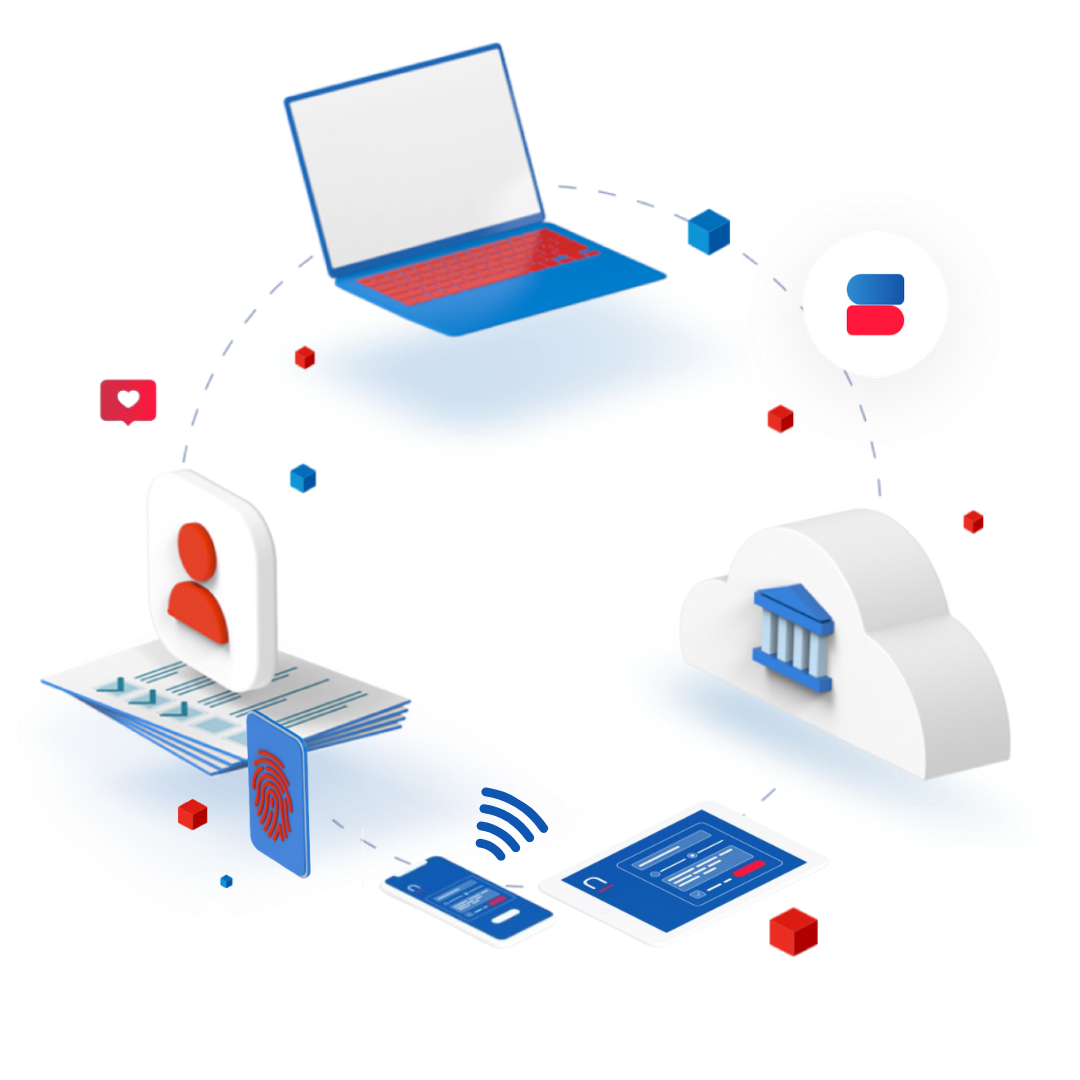

Elevate your customer onboarding with Sancus, a dedicated KYC solution crafted for diligent and quick customer and merchant verification, equipped with ID verification, AML checks and case management features — all housed within a single, comprehensive platform.

Revolutionize your client verification process with Sancus today.

Empower your company to stay compliant and secure by effortlessly connecting and validating client information from diverse sources. Sancus is the key to ensuring that payment services companies can confidently and thoroughly check their clients, enhancing security, compliance, and overall operational efficiency.

With norbloc’s digital onboarding platform, you can forget about cumbersome and time-consuming compliance processes; Keep up to date customer records and connect disparate information sources for improved KYC and AML compliance and swifter client onboarding.

What does the platform offer?

Quickly verify clients and merchants

Verify customers and merchants across the globe using holistic identity verification solutions equipped with document verification and matching, liveness and biometric checks for individuals and corporate customers.

Robust mechant onboarding

Compete in today’s payments landscape with tailored digital onboarding journeys for your merchants.

Use the Sancus drag-and-drop workflow editor to customize step sequences, incorporating public and private data sources to dynamically prepopulate and verify merchant information, no matter their location.

Protect against risk and hefty fines

Fortify your AML with automated, real-time checks occurring in the background while your customer or merchant uploads their information to remain secure and save time.

Include thorough PEP checks, screening against international databases and customize risk rules to maintain ongoing monitoring where your risk appetite necessitates.

Sancus offers a centralized platform for managing client information. This helps payment service providers keep customer files up to date and ensures consistency across different processes.

Offer dynamic digital customer journeys to ensure your compliance while guaranteeing a refreshing onboarding experience for both customers and merchants.

Automation of KYC and AML processes reduces the need for manual labor and minimizes the risk of human error. Beyond elevating customer satisfaction, you save resources and time.

Payment platforms operate in a highly regulated environment. Sancus helps ensure compliance with regulatory requirements by creating robust workflows for all use cases, thus protecting from fines and penalties.

© 2023 Norbloc. All rights reserved.