Trading

Offer effortless customer onboarding while meeting stringent compliance obligations worldwide with simplified KYC and AML via the Sancus orchestrator platform.

Tailored to the unique needs of trading firms, Sancus empowers firms to navigate KYC procedures efficiently and build trusted client relationships in the dynamic world of global trade.

Bid farewell to cumbersome and time-consuming processes as Sancus ensures seamless KYC and AML compliance. This platform goes beyond traditional solutions, allowing trading companies to maintain up-to-date customer records and seamlessly check traders worldwide, fostering customer loyalty, trust and success.

What does the platform offer?

Worldwide Customer Due Diligence

Trading firms struggle to verify and maintain accurate data on their traders across the globe, but it doesn’t need to be this way.

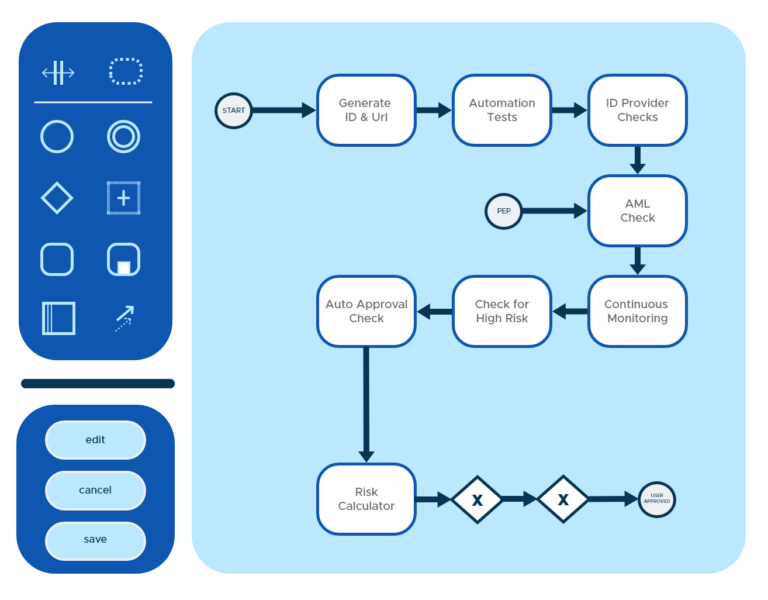

Confirm the legitimacy of traders and their activities no matter where they’re located by using the drag-and-drop workflow editor to create tailored customer journeys for any jurisdiction.

Swift and Seamless ID Verification

Verify the identity of traders through reliable identity documents such as government-issued IDs, passports, or other recognized forms of identification.

Only where necessary, implement advanced verification methods like Proof of Address (PoA) and liveness checks to ensure the authenticity of trader and minimize risk.

Fortify AML screening

Secure your firm against any involvement in money laundering activities by screening traders against global watchlists, Politically Exposed Persons (PEP) databases, and sanctions lists to ensure compliance with AML regulations.

Leverage custom risk rules to monitor suspicious behaviour, and set up notifications and automatic review for thorough, ongoing AML screening.

Scale with Sancus

Go global with Sancus, a KYC and AML solution that scales as you grow, with flexibility to keep you compliant with regulations across the globe.

Customize verification processes effortlessly to align with your Anti-Money Laundering (AML) policy, ensuring the integrity of your customer base while keeping them satisfied. Craft diverse verification workflows tailored to individual user risk profiles and regulatory requirements, trigger additional checks based on user actions, and establish prompts for manual case reviews—all achieved seamlessly with our easy-to-use workflow editor.

Drag-and-drop to create the perfect workflow, or allow us to do it for you.

Leverage dynamic journeys and tailored risk rules to reduce drop-off rates and increase customer satisfaction.

Ensure your firm is compliant with regulatory requirements everywhere your customer base is located.

Protect your trading firm and your customers by executing thorough AML checks and periodic review.

Stay aware of regulatory changes via the Officer Portal to secure user journeys that always meet your needs.

© 2023 Norbloc. All rights reserved.