In the rapidly evolving landscape of finance and regulatory compliance, staying ahead necessitates a comprehensive understanding of the historical journey, current challenges, and the path forward. The transition from traditional banking to the rise of fintech, cryptocurrency emergence, and the advent of decentralized finance (DeFi) has significantly altered the compliance terrain. This evolution is driven by technological advancements, regulatory responses to crises, globalization, and emerging risks.

Earlier this year we witnessed Coinbase being issued a fine of 50 million dollars for lack of compliance with AML regulations. Specifically, their compliance function couldn’t keep up with the pace of growth in their transactions. In other words, the team could not investigate all the alerts and close the investigation loop of extended due diligence within the required timeframe and hence found themselves non-compliant.

Similarly, just a few weeks ago, global payments provider, WISE, paused taking on new business clients in Europe citing lack of capacity to handle extended due diligence and meet the changing regulatory requirements.

There are many more such examples in the recent past, all highlighting a key problem, “lack of scalability in existing systems” – and this obstacle cannot be overcome by adding more people to the process pipeline.

A Chronology Leading up to Lack of Scalability in Existing Systems

In the early 2000s, the financial sector was predominantly characterized by large banking institutions which had only just started using digital means for data entry. As this growingly became more commonplace, regulations adapted to reflect this digital trend.

Since then, regulatory scrutiny has intensified with a focus on risk management, transparency, and accountability for all financial products and transactions. It is also from this point, the regulators started issuing fines for non-compliant entities that couldn’t keep up with the pace (we have seen a lot of examples on a global scale fined in millions of dollars till now).

Now, every 5 years there is a new boom in the sector that leads to further regulation, complexity, and scrutiny.

- Traditional Banking (2000-2010): Focused on established banks, stability, and prudential regulations.

- Global Financial Crisis (2008): Prompted a regulatory overhaul with measures like the Dodd-Frank Act.

- Rise of Fintech (2010-2020): Introduced innovative technologies, challenging traditional services.

- Cryptocurrency and Blockchain (2010-present): Presented new regulatory challenges and considerations.

- The DeFi and Digital currencies surge (2020-present): Prompted increased scrutiny in non-traditional sectors.

- ESG reporting (2022-present): Expanded regulatory oversight to new sectors and subject matter.

As the industry offerings increasingly move into the digital realm, the whole horizon of regulation is in a constant state of dynamic coverage and adaptation.

Indeed, both financial entities at micro-level and the regulatory bodies at macro-level have adapted to this evolution, performing a balancing act between innovation, consumer protection and compliance.

To strike this balance, to date, financial entities have predominantly been deploying semi-automated solutions and pumping up the personnel in their compliance teams to help with due diligence — but it hasn’t been without cost.

The Exponential Increase of Compliance Costs

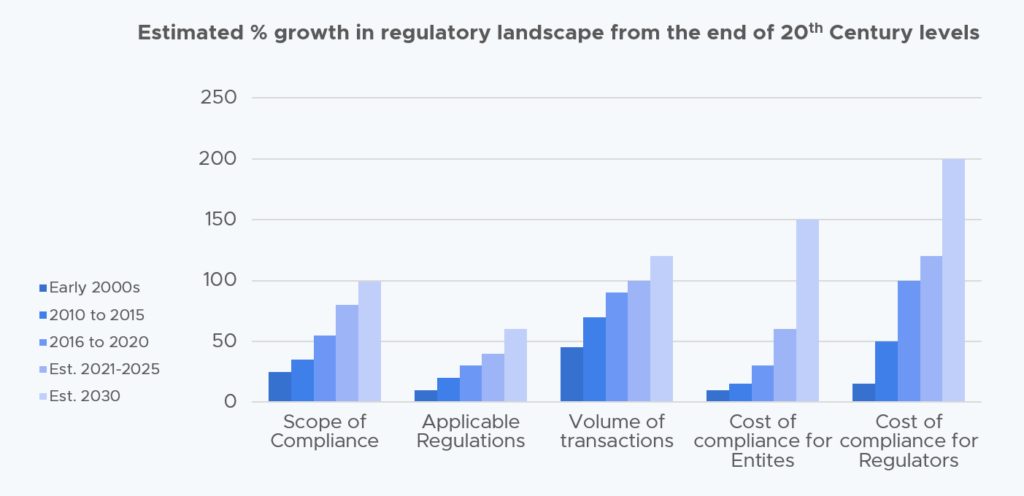

Statistics show that over the past two decades the scope of compliance and volume of transactions have increased by more than 100%. Important to note that in the same timeframe, the cost of compliance has gone up by nearly 200% for both the financial entities and the regulators.

This is an unprecedented and disproportionate hike not just for businesses, like Coinbase or WISE, but even the regulators have been drowning in the operational cost to enforce compliance.

Why is that the case?

Lacking a Holistic Technology Approach

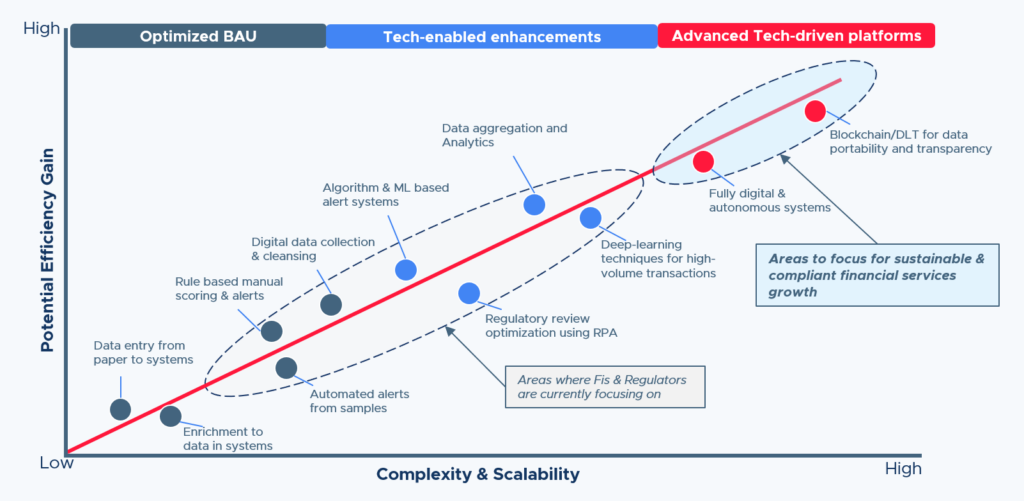

Within just a couple of decades the industry has swiftly progressed from manual data entry to modular platforms.

Take a closer look and you will find that the focus of technology adaptations by financial bodies till date, have predominantly been micro-focused solutions; rule-based systems or semi-automated mechanisms and manual customer due diligence (CDD) and enhanced due diligence (EDD) processes.

This approach became popular as it presented itself as an easy win; financial entities could be seen as being more innovative as they were digitizing their processes, while simultaneously growing their company and “tackling” regulatory compliance.

This has been defiantly good but not great;

These solutions do offer improvements in operations, but they fall short in providing required efficiency at scale.

Furthermore, lacking a holistic approach, financial entities are barely able to keep up with the multi-dimensional regulatory needs or volume of compliance — and attempts to do so have led to disproportionate spending across the board.

Cutting-edge Solutions to Future-Proof Compliance

The industry is now at a crucial juncture where the demand for fully digital and autonomous solutions is becoming imperative.

Fully digital solutions leverage end-to-end automation, they not only reduce the dependency on manual processes, but also help to break the mould of micro-service providers which constrict platforms to just handling one set of data.

To achieve true scalability and security in compliance, the industry must embrace Distributed Ledger Technology (DLT) and solutions built on blockchain technologies.

DLT ensures decentralized operations, a reduction in both cost and resources while also facilitating exponential growth in business with ease.

The secure ledger facilitates transparent, tamper-proof, and real-time record-keeping ability.

Never before in the history of technology enablement have we had such a power to truly trace a transaction and its data right from its origin up to the destination along with all the handlers and verifiers in-between.

Needless to say, the focus has to shift to these technology platforms both for financial institutions at a micro-level and for regulators at a macro-level, to handle scalability and agility in the regulatory space.

norbloc, Driving Innovation with Digital Platforms

Since inception in Stockholm back in 2016, norbloc has not only embraced technology advancements with blockchain, but has also been in the forefront of innovation in the RegTech data space.

Over the years, norbloc has grown into a global force, with presence in 4 international locations, spanning Sweden, UAE, the UK, and Greece.

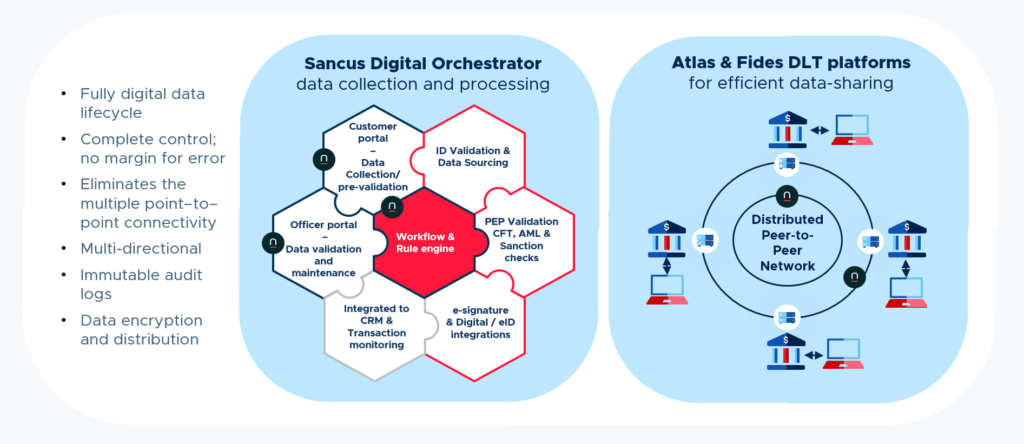

At the heart of norbloc innovation there are 3 interoperable platforms — Atlas, Fides, and Sancus.

These platforms are meticulously designed in alignment with data protection laws and the GDPR to meet the diverse regulatory data needs of the industry.

Simultaneously, norbloc customers enjoy end-to-end comprehensive solutions for navigating the complexities of handling compliance data.

As a result, norbloc’s commitment and innovation in the RegTech space has not gone unnoticed.

Norbloc has been recognized on the global stage several times over the last 8 years, including recurring placement within the prestigious RegTech100 list, accolades from McKinsey/Google as one of the most forward-thinking companies in Europe, and being awarded the highest accolade for the Fides solution by the Monetary Authority of Singapore at Singapore Fintech Festival 2022.

Digital Orchestrators and DLT Platforms for Sustainable and Scalable Solutions

norbloc has your regulatory needs covered, offering a suite of interoperable platforms that cater to the complete spectrum of know your customer (KYC) and anti-money laundering (AML), from gathering to maintaining and sharing data securely.

Individually each of norbloc’s solutions have helped increase efficiency and lower the cost of operations for customers — and when these solutions are combined, then we see a paradigm shift in efficiency and scalability.

Sancus, The Digital Orchestrator

Sancus is the digital orchestrator platform which helps financial institutions and other regulated entities manage their compliance needs perpetually. In particular, Sancus addresses KYC data collection, verification and AML checks with easy to use functionalities for ongoing monitoring and renewals.

In doing so, Sancus provides flexibility and agility, allowing the client freedom to choose between data providers, customer journeys, degree of automation and system integrations, and adapting to regulatory changes seamlessly.

As a low-code platform, no downtime is needed to modify the compliance process in-tune with the agile regulatory guidelines.

Atlas and Fides, The DLT Data Sharing Platforms

Atlas is the platform used to eliminate rework and duplications on compliance for multinational and large institutions by allowing data sharing across teams and regional borders.

Similarly, norbloc’s flagship platform, Fides, is built on blockchain to ensure a single version of truth per customer file, but while Atlas works within an institution, Fides is leveraged across multiple collaborating entities — starting from the customer to the financial entity, to the data provider, the compliance teams, auditors and all the way up to the regulators.

These platforms are the foundation for data sharing ecosystems that operate with complete trust and transparency. Both data sharing platforms, Atlas and Fides, provide an immutable audit history and most importantly security in data sharing without having to duplicate the efforts and resources.

Platforms Catering to the Complete Range of Compliance Needs

From an industry perspective, Sancus ensures compliance at the micro-level, while Fides and Atlas ensure governance and compliance at a macro-level, with increased scale of transactions and decreased cost of operations.

The adoption of the Fides platform in the United Arab Emirates is a testament to the power of innovation and collaboration for shaping the future of an exponentially scaling industry.

Since 2020, collectively the platform has reduced more than 1 million man-days in compliance data processing for norbloc’s bank customers.

Additionally, financial entities and banks that are part of the ecosystem have been handling double the volume with quicker onboarding times and direct access to validated data from the authorities to ensure regulatory adherence.

Needless to say, the UAE and MENA region have always been early adopters of cutting-edge innovations and they have proven this once again in norbloc’s journey.

For the rest of the world, we are assertive that financial entities and regulators will soon realize the need for such strategic investments in technology, to future-proof regulatory compliance.

This article is based on Viji’s presentation, “Future-proofing Compliance with Autonomous and Secure Platforms”, presented at the 7th MENA RegTech Forum organized by Cogent Solutions that took place on 15th November 2023 in Abu Dhabi, United Arab Emirates.