Marketplaces

Shopping online is great, but it also comes with risks. Sometimes, bad actors try to cheat the system, engaging in illicit activities, such as fraud and money laundering.

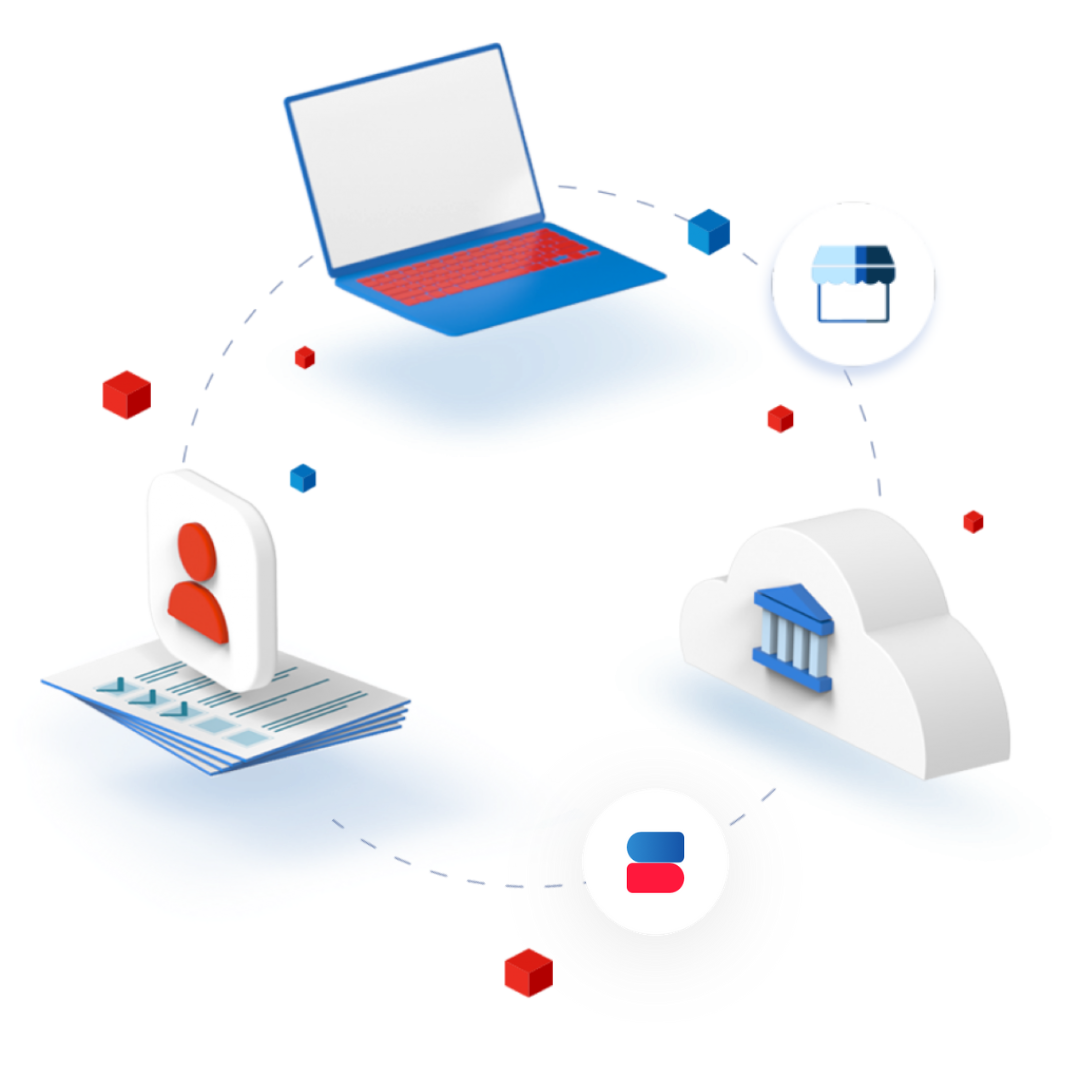

To avoid these risks, online marketplaces need to verify and validate their customers beforehand, making sure everyone is who they say they are to keep shopping and information safe.

This is where online marketplace ID verification comes in – a security guard for online shopping, ensuring entities and actors are who they claim to be.

With norbloc’s digital onboarding platform, Sancus, you can forget about cumbersome and time-consuming compliance processes; Keep up to date customer records and offer effortless customer journeys for improved KYC and AML compliance and swifter client onboarding.

What does the platform offer?

Merchant Onboarding

Streamline the onboarding experience for merchants with Sancus. Our platform provides a seamless and efficient onboarding process, allowing marketplaces to swiftly integrate new sellers while ensuring compliance with KYC regulations.

Sancus is not just a tool, it is the solution that simplifies and enhances the merchant onboarding journey.

Identity Verification for Sellers

Sancus ensures airtight identity verification equipped with proof of address, liveness and biometric checks, validating the authenticity of sellers seamlessly.

Choosing Sancus means choosing a solution that sets the golden standard for secure and reliable identity verification in online marketplaces.

AML Screening

Mitigate financial risks and safeguard your marketplace with Sancus’ powerful Anti-Money Laundering (AML) screening. Our platform meticulously screens sellers against watchlists for Politically Exposed Persons (PEP) and sanctions lists, offering unparalleled security.

Ongoing Monitoring

Implement alerts aligned with your personalized risk-appetite for ongoing monitoring in online marketplaces. With real-time insights the Sancus platform empowers marketplaces to proactively identify and address potential risks.

Trust Sancus to be your vigilant ally, ensuring secure and compliant transactions within your marketplace.

Create simple digital onboarding journeys, so your customer can quickly get to shopping or selling accordingly.

Maintain up to date data for each KYC file, allowing the merchant to seamlessly update their information via the Customer Portal.

Cut costs and save time by automating periodic review and ongoing monitoring based on tailored risk ratings.

Protect your reputation by offering your customers tailored journeys that keep you secure from financial crime.