Saying goodbye to 2024, we’re here to fill you in on the highlights of the last quarter of the year; from the Financial Action Task Force (FATF) updates, to new AML guidelines coming out of the European Banking Authority (EBA) that set to harmonize national policies within the financial sector and the case of fines and fraud in the United Kingdom — more on all this below.

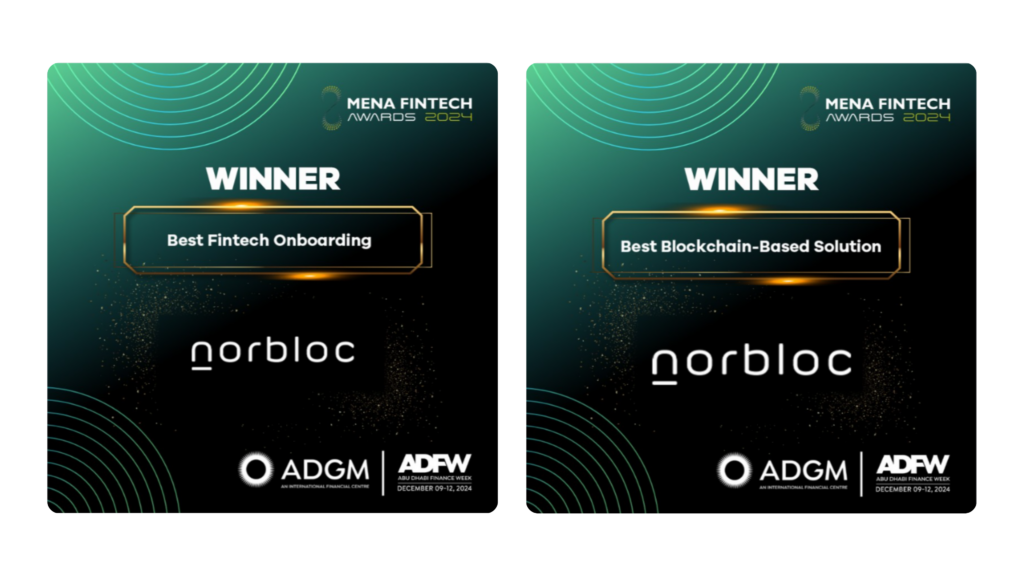

For those who missed it, norbloc won two awards at the MENA FinTech Awards at Abu Dhabi Finance Week 2024 and we are celebrating! Celebrating the recognition of our powerhouse, end-to-end orchestration platform, Sancus, and innovative Fides solution that powers the eKYC Utility in the UAE.

💡Industry news worth knowing

The Financial Action Task Force (FATF) held its first plenary session under the presidency of Elisa de Andra Madrado and some of the key updates include:

- Changes to the grey list with 4 countries being added, Algeria, Angola, Côte d’Ivoire and Lebanon, whilst Senegal was removed.

- Approval of revised guidance for national money laundering risk assessments to help all jurisdictions understand and mitigate their risks, following recent updates to FATF’s grey list criteria.

- Revisions focusing on Recommendation 1 are being considered to better align with measures to promote financial inclusion through increased focus on proportionality and simplified measures in the risk-based approach.

In the meantime, the European Banking Authority (EBA) hopes to set EU-wide standards for AML and has recently issued final guidance on financial institutions’ governance arrangements. policies, procedures and AML controls.

The EBA acknowledges that such weaknesses and inconsistencies expose financial entities to legal and reputational risks, while also undermining collective efforts and undercutting the integrity of the European internal market. The final guidance comes in two sets of Guidelines:

- The first set of Guidelines addresses the necessary provisions for ensuring governance and risk management systems that are “sound and sufficient” by directing financial entities to review compliance procedures, train staff, conduct risk assessments and overall implement a holistic governance framework.

- The second set of Guidelines is specific to payment service providers (PSPs) and crypto-asset service providers (CASPs) specifying the necessary screening measures required when performing transfers of funds or crypto-assets.

European financial entities are advised to consult the new Guidelines in full to ensure compliance with the EBA’s instructions.

Noteworthy that the year is coming to a close and the Financial Conduct Authority has handed out £176 million in fines to firms and individuals for financial crime failings, with several global names standing out for their shortcomings, such as HSBC, Barclays and Citi Group.

More recently, the FCA imposed fines of £16 million on Metro Bank for failings in their financial crime systems and controls, including leaving severe gaps in their automated transaction monitoring systems for almost 5 years.

Furthermore, this year the FCA fined PwC £15 million for failing to report to the regulator their belief that their client might be involved in fraudulent activity — marking this as the first time the FCA has ever fined an audit firm.

Therese Chambers, Joint Executive Director of Enforcement and Market Oversight at the FCA, said:

“Auditors have a central role to play in keeping our markets clean. They have privileged access to information and they are required by law to report suspicions of fraud to the FCA.”

Therese Chambers highlighted the seriousness of these failings as they left the financial market exposed to criminal misuse and undermined collective efforts towards anti-money laundering and counter terrorism financing.

Now, it’s no secret that the UK is doubling down on fraud which now accounts for ~40% of all crime in England and Wales, and has increasingly become cyber-enabled. In 2023, nearly £1.2 billion was lost to fraud; Now for 2024, the total reported fraud value is estimated at £2.3 billion indicating a persistent threat to individuals and businesses.

As a result, the government has introduced a series of measures to reduce fraud and to protect those who fall victim:

- The Mandatory Reimbursement Scheme has been introduced for victims of authorized push payment (APP) in response to £460 million lost to APP fraud throughout 2023 across 230 thousand fraud cases.

- The Failure to Prevent Fraud offence is a new a corporate criminal offence that will be introduced to hold large entities accountable if they are unable to demonstrate reasonable fraud prevention measures and have profited from fraud. With a clear anti-fraud culture underway in the UK, the time to buckle up is now — more robust fraud measures, greater accuracy in AML checks and more holistic KYC.

📌 In case you missed it…

norbloc and DDCAP Group™ announce their strategic partnership for future-proof, digital customer onboarding

Pictured left to right: Astyanax Kanakakis, CEO and Co-Founder, norbloc, Callum Burgess, Director, Digital Partnerships and Business Solutions, DDCAP Group™, Stella Cox CBE, FCSI(Hon) Managing Director, DDCAP Group™, Lawrence Oliver, Director, Deputy CEO, DDCAP Group™

Following the successful implementation of the recently awarded Sancus orchestration platform, DDCAP makes use of tailored workflows equipped with AML and KYC, embedding sanctions related controls and adverse media checks for holistic onboarding. norbloc’s Sancus platform has the flexibility to be configured according to the heavy demands of our ever evolving and expanding global network of clients.

David Testa, Executive Director and Head of Client Services and Corporate Governance at DDCAP Group™ said:

“We believe the infrastructure provided by norbloc to be an important part of our security resilience measures, which are built to meet the highest standards required in the industry today, but with a clear eye open for future legislative and regulatory requirements.”

norbloc is awarded Best FinTech Onboarding and Best Blockchain-based Solution at Abu Dhabi Finance Week 2024

We are proud to announce, norbloc has been recognized with two awards at the MENA FinTech Awards 2024 that took place at the heart of Abu Dhabi Finance Week 2024. A warm thank you to MENA FinTech Association and the esteemed jury for singling out norbloc’s innovative solutions with Best FinTech Onboarding and Best Blockchain-based Solution.

Astyanax Kanakakis, Co-Founder and CEO of norbloc highlighted:

“It’s truly an honour to have both our solutions, Sancus and Fides, receive such recognition. This is a reflection of the norbloc team’s expertise in the RegTech space, especially within the banking and financial sector but also goes to show that our solutions are created with longevity in mind.”

Careers at norbloc

norbloc is made up of people with all types of experiences, backgrounds and career paths. We want our team to reflect the diversity of our customer base and the world at large.

Are you looking to make the next step in your career?

- Position now open: Full Stack Software Engineer