Below is a brief introduction to the topic of DLT versus API, discussing the key differences, weaknesses and advantages that each have when it comes to sharing and consuming legally significant data. We also put forward the key questions and considerations Banks and FIs should be asking themselves to make the right decisions for their organization. Our views are based on extensive work building the first ever distributed KYC utility in the world, which employs both DLT and API elements.

—

The seemingly simple choice of APIs

Back when process automation was initiated, one of the biggest challenges faced by B2B companies was access to data in a swift and reliable manner. In parallel, the cost of hosting all applications on-premise was ballooning due to the heavy specifications required to maintain multiple applications. It was at this juncture that Application Programme Interface or most commonly known as API was introduced.

APIs provided efficiency for large platform providers to host and maintain a single platform in a region and expose the APIs to their customers who wanted to transact data. In short, APIs allow one piece of software to make use of the data of another by creating a machine-to-machine interface. With the advent of microservice architecture, more and more platforms turned to the ease of providing the services through Rest APIs.

While APIs could have made the cost and maintenance easier for large platform providers, it definitely increased the cost of integration, rework on middleware and maintenance of the gateways for the entities utilizing the APIs.

—–

DLT for secure data access and sharing

Distributed Ledger Technology, such as blockchain, in its core is simply the technological infrastructure and protocols that allow simultaneous data access, verification and validation of data sources, and record transactions across the networked databases.

For APIs the initial investment might appear to be lower and the implementation is seemingly simple, but it would turn complex and expensive if several APIs are to be consumed by a financial institution, bank or any other organization.

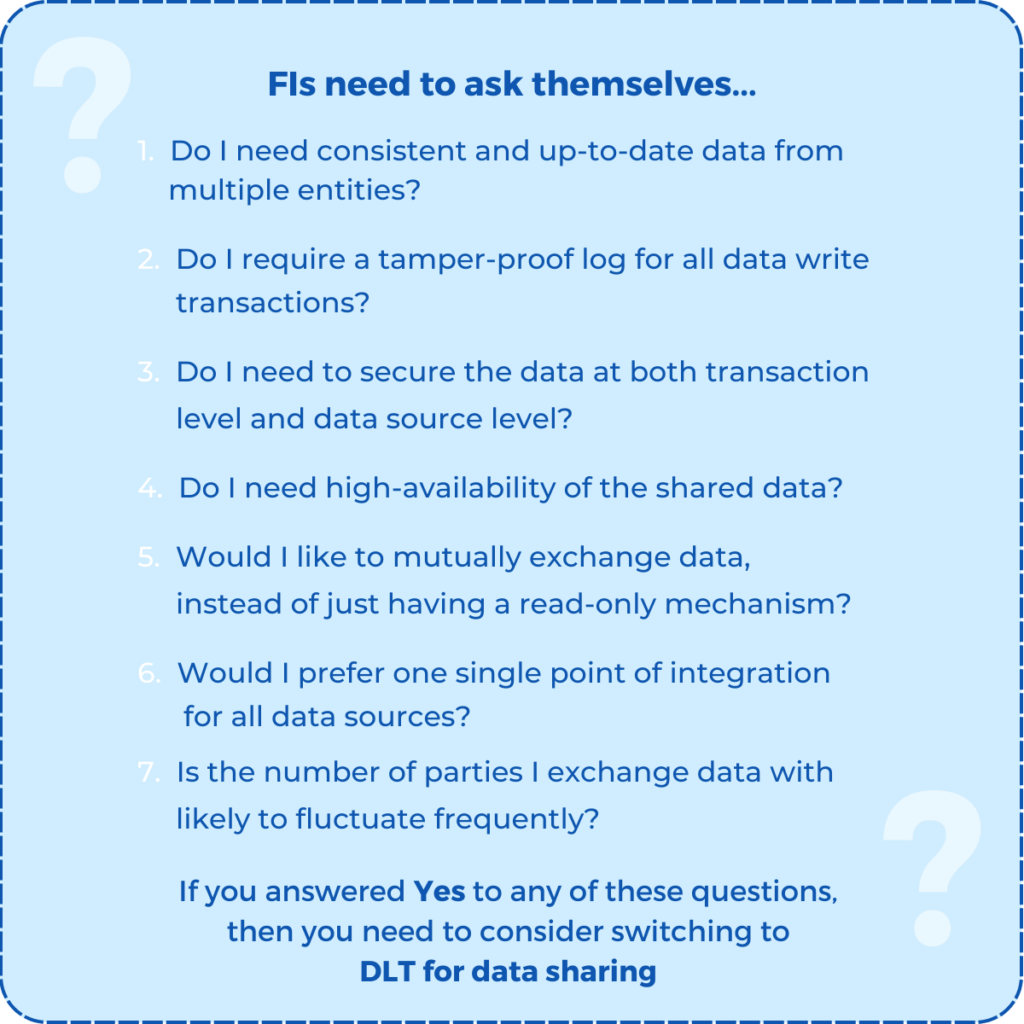

For DLT-based applications, the inverse holds true; the initial investment is comparatively higher, but highly self-sustained and economical with scaling up of data sources. By implementing a DLT-based application for data sharing financial entities and other organizations stand to reap multiple benefits.

—-

Some of these benefits include…

- Ensured high availability of data via the platform

- Immutable audit logs for all transactions

- Verification and validation of data fields

- Synchronized and seamless remediation

- Data encryption and distribution rendering security breaches almost impossible; no single point of failure

- a single point of integration for all data sources irrespective of the use case, with just one node

—

————–

At Norbloc we’re redefining KYC & KYB from onboarding to validation, sharing and beyond. Find out more about DLT vs. API in our upcoming report and webinar!

Stay updated by subscribing:

Contact us to find out how we can help you.